News

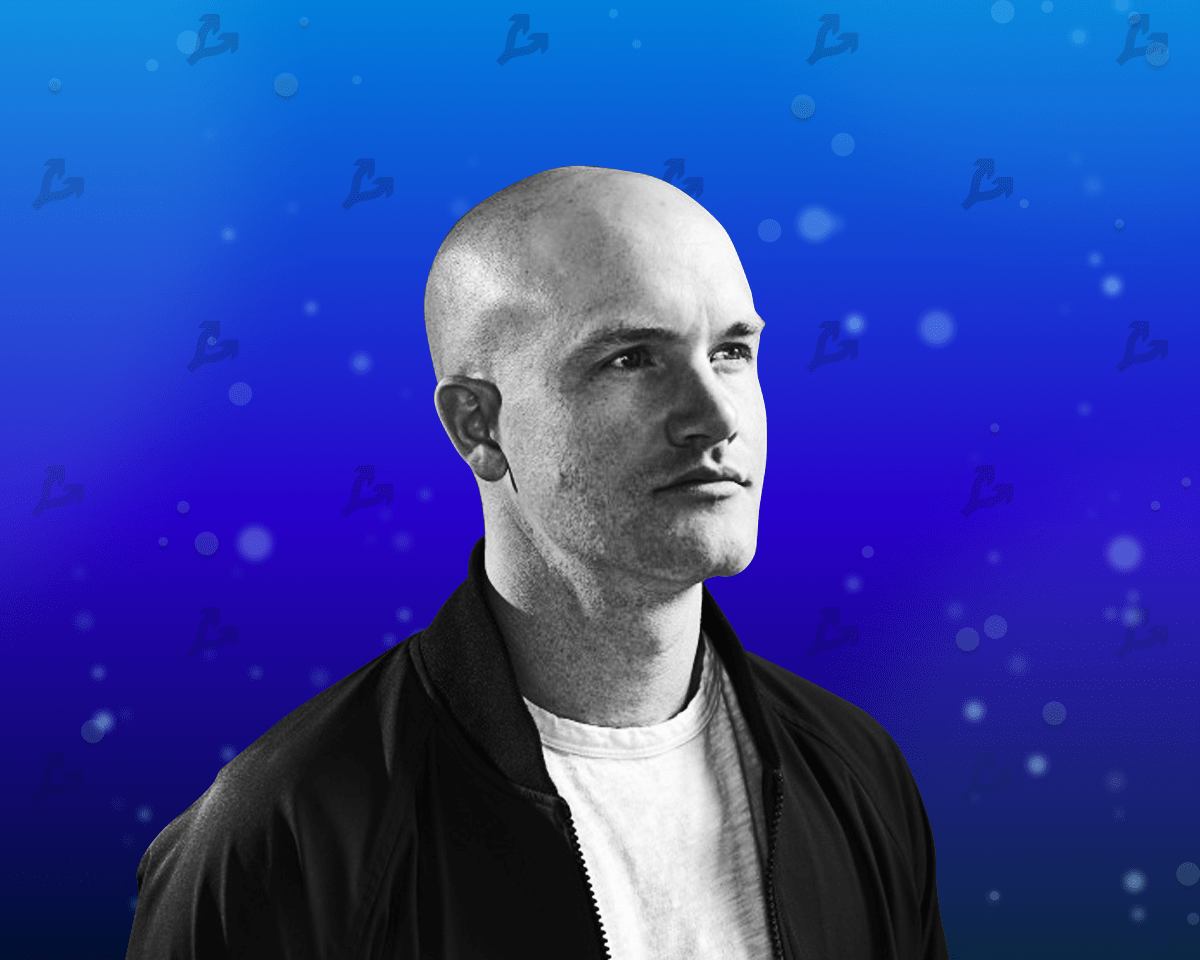

Brian Armstrong eliminated the influence of the FTX crisis on Coinbase

Brian Armstrong eliminated the influence of the FTX crisis on Coinbase

Coinbase is not affected by the crisis in which the FTX platform was, and nothing threatens its users. This was stated by CEO of the American Bitcoin-Birzhi Brian Armstrong.

2/ Second, Coinbase Dogesn’t Any Material Exposure to Ftx or FTT (And No Exposure to Alameda).

– Brian Armstrong (@brian_armstrong) november 8, 2022

“Firstly, I really sympathize with everyone who is involved in the current situation with FTX […]. Secondly, Coinbase has no significant attitude to FTX or FTT (and ALAMEDA), ”Armstrong wrote.

In his opinion, Sam Bankman-Frida, who covered the platform, was the result of “risky business practice, including a conflict of interest between closely interconnected organizations”. He called another reason «misuse of customer funds».

Armstrong emphasized that Coinbase does not dispose of user assets without their knowledge, and they can “withdraw money from the exchange at any time”.

5/ We Don’t Do Anything with Oour Customers’ Funds Unless Directed to the Customer. We Hold All Asset Dollar for Dollar, and Users CanWDRAW THIRA Money at ANY TIME.

– Brian Armstrong (@brian_armstrong) november 8, 2022

April 14, 2021, a direct listing of Coinbase shares on Nasdaq took place. https://gagarin.news/news/problems-of-bitcoin-implementation-the-survey-results-of-salvadorans/ Armstrong emphasized that the status of a public company registered in the United States obliges the platform to adhere to transparency.

“Each investor and client can familiarize themselves with our public financial reports that have passed the audit,” CEO added.

He also recalled that Coinbase did not release its own token unlike ftx. One of the problems of Cryptobirge Armstrong called the concentration of regulators in the markets controlled by him, while customers “moved abroad in the company with a more opaque and risky practice of doing business”.

“We must continue to work with politicians in order to create reasonable regulation for centralized exchanges/castodians in each market (as we did for some time), but then we need to provide equal conditions of the game, which has not yet happened,” concluded Chapter Coinbase.

Previously, UTILITY TOKEN FTX (FTT) fell by about 30%-with levels above $ 22 to marks below $ 16.

The collapse occurred against the background of rumors about the confrontation between Binance and FTX, as well as fears regarding the financial stability of the latter. At the same time, the price of bitcoin failed the level of $ 20,000, pulling the entire market.

On November 6, CEO Binance Chanpen Zhao announced the company’s desire to get rid of ftt. Assets together with Busd in a total of ~ $ 2.1 billion steel by the company output from portfolio investment in FTX.

Recall, on November 8, Bankman-Fried and Zhao announced a strategic partnership. It is designed to resolve the liquidity crisis and involves the possible absorption of the FTX exchange of Binance.

Read the FORKLOG Bitcoin News in our Telegram-cryptocurrency news, courses and analytics.